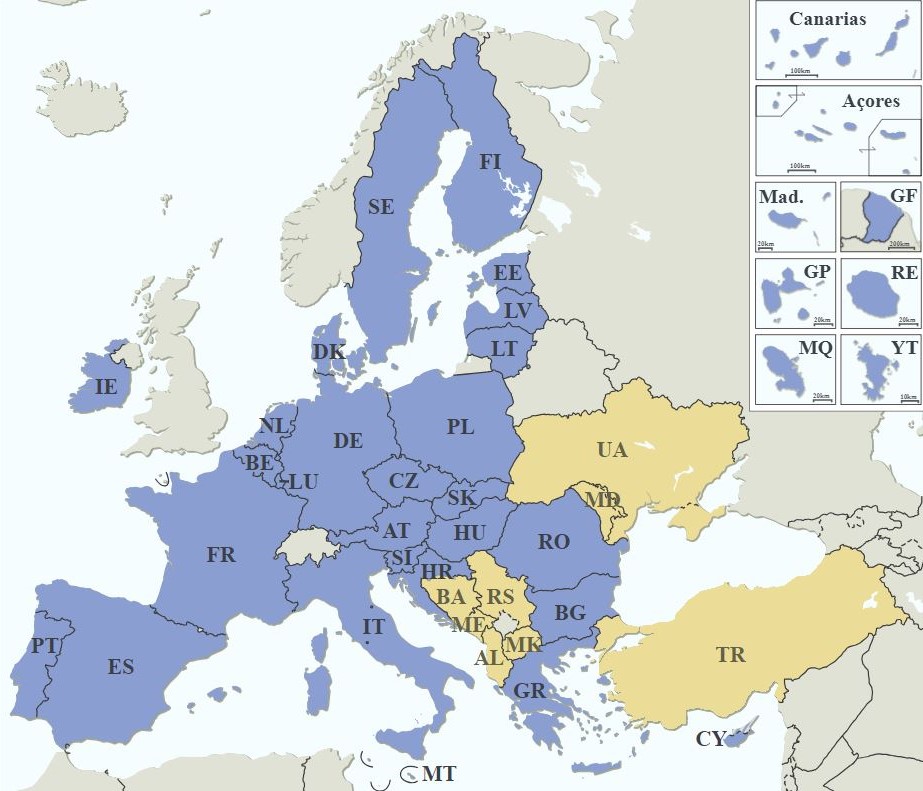

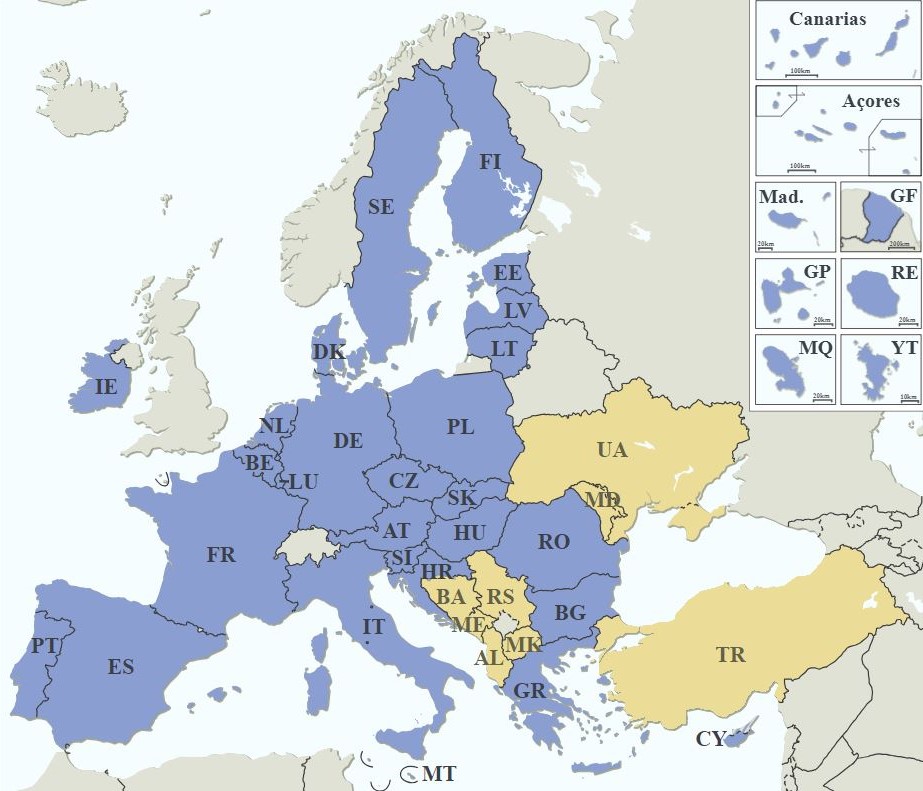

Check your VAT number if enabled for intra-European purchases with VAT EXEMPTION.

GO TO THE EUROPEAN UNION WEBSITE

You can always enable it by asking your accountant.

Check your VAT number if enabled for intra-European purchases with VAT EXEMPTION.

GO TO THE EUROPEAN UNION WEBSITE

You can always enable it by asking your accountant.